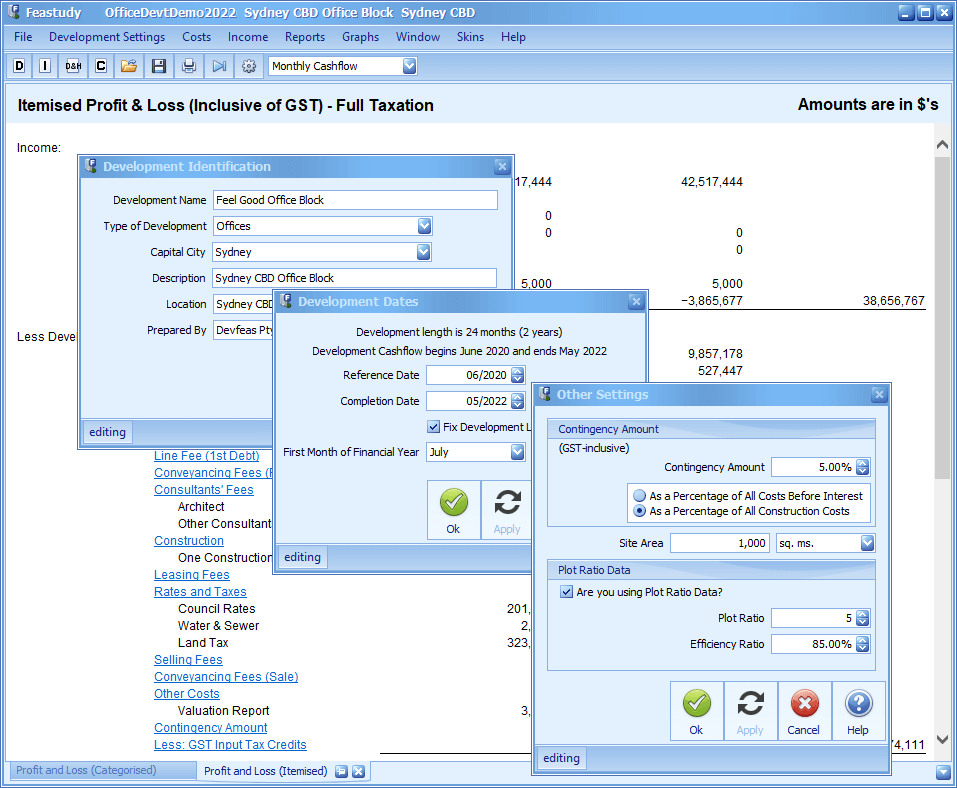

Property Feasibility Studies Made Easy on a PC

Imagine undertaking financial feasibility studies for property development projects and property investments

with consummate ease on your desktop, laptop or notebook, i.e. without much prior feasibility software tuition

but with plenty of 'thinking' already done for you and lots of easily-accessed help available to you.

Using either version of Feastudy 11 does not even require a knowledge of how to use

Microsoft Excel because both versions of Feastudy 11 run independently

of it. Furthermore, in Feastudy 11 Professional you

can export every type of its reports for a feasibility study file to a CSV file. You can then open

that CSV file in Excel and save its contents in an XLSX file.

Feastudy 11 Professional

Feastudy 11 Professional provides the following features, which are not

included in Feastudy 11 Lite:

-

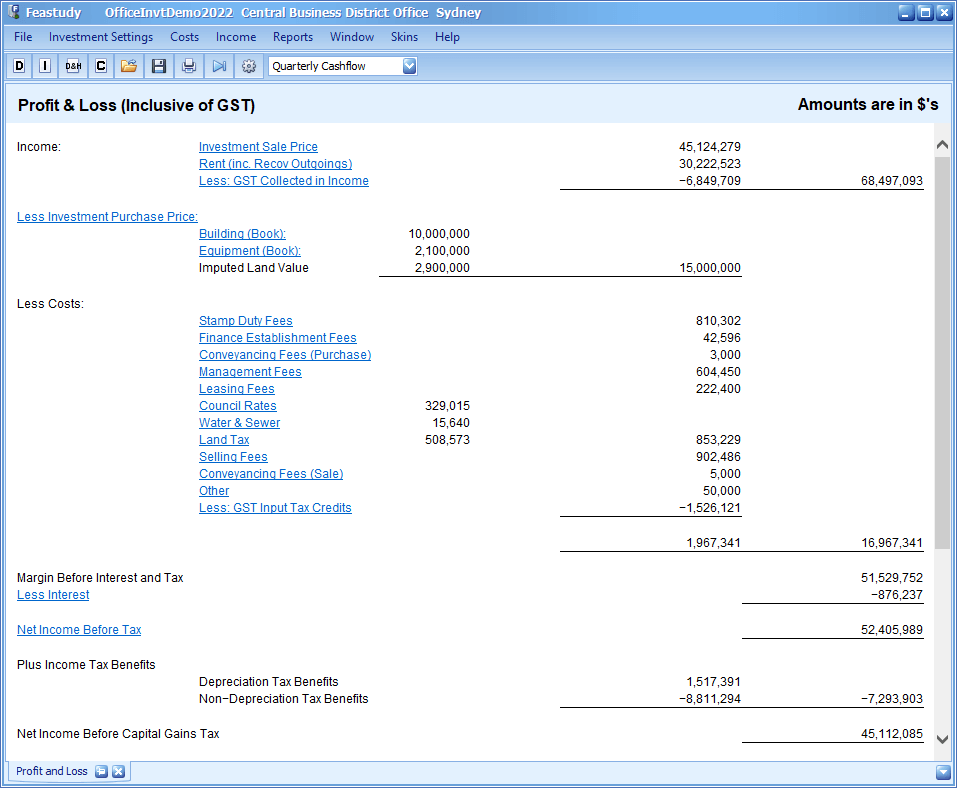

Investment feasibility study facilities;

-

Residual Investment Value (RIV) calculations;

-

Develop-and-Hold (D&H) Investment feasibility study facilities;

-

specific data entry facilities and calculations for secondary debt funds and their loan establishment fee;

-

specific data entry facilities and calculations for joint venture developments;

-

the ability to have both the margin scheme and full taxation methods of GST-taxation of development sales

in the one file;

-

the ability to consolidate the Categorised Cashflows for up to thirty (30) constituent Development files in a Consolidated Development file;

-

monthly/quarterly/annual loan to value ratio (LVR) calculations for developments;

-

monthly/quarterly/annual cashflow interval options for development and investment studies;

-

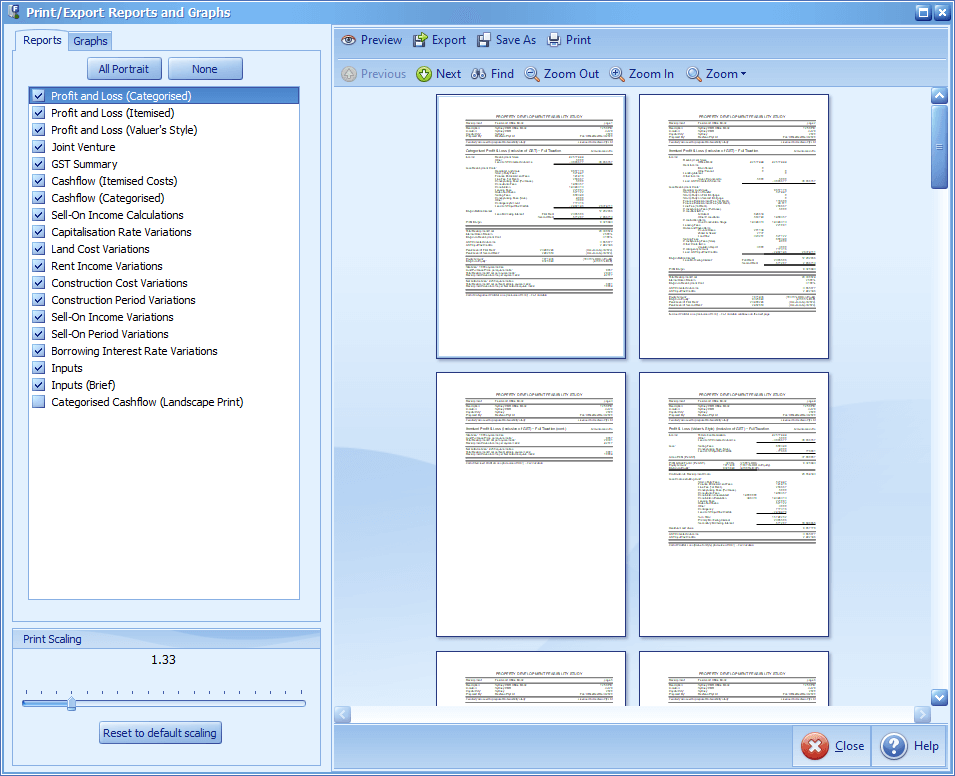

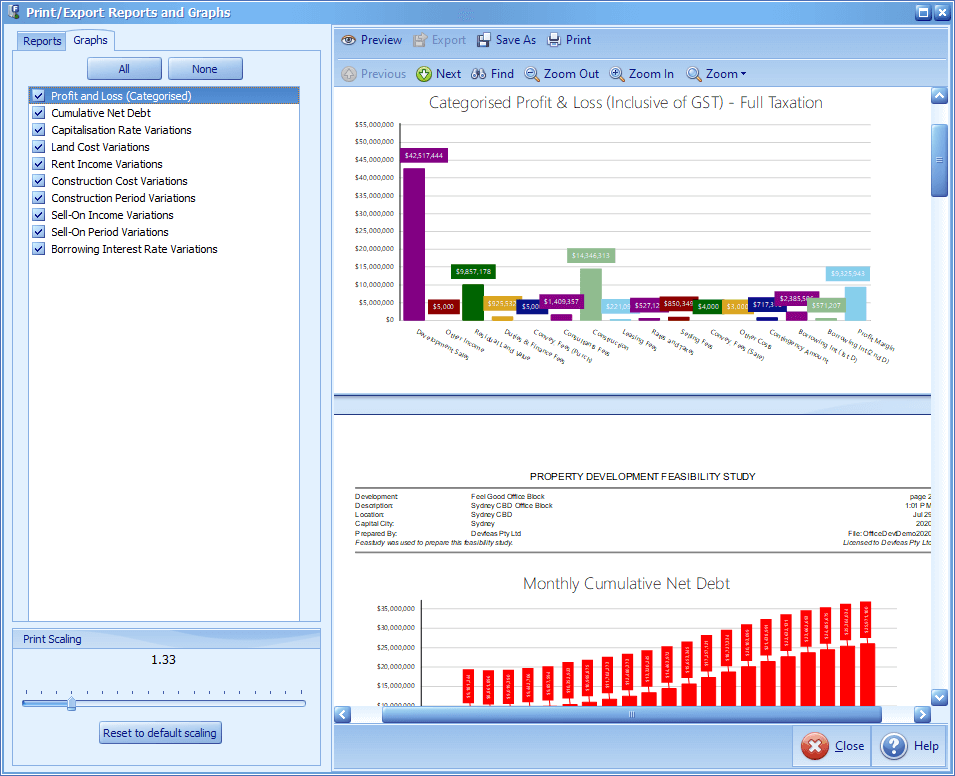

facilities for exporting all program reports to a CSV and/or a DOCX file;

-

a facility for entering notes for each file-specific data entry window (which can be printed in the file's

inputs reports); and

-

a facility for expediting an email message to Devfeas Pty Ltd.

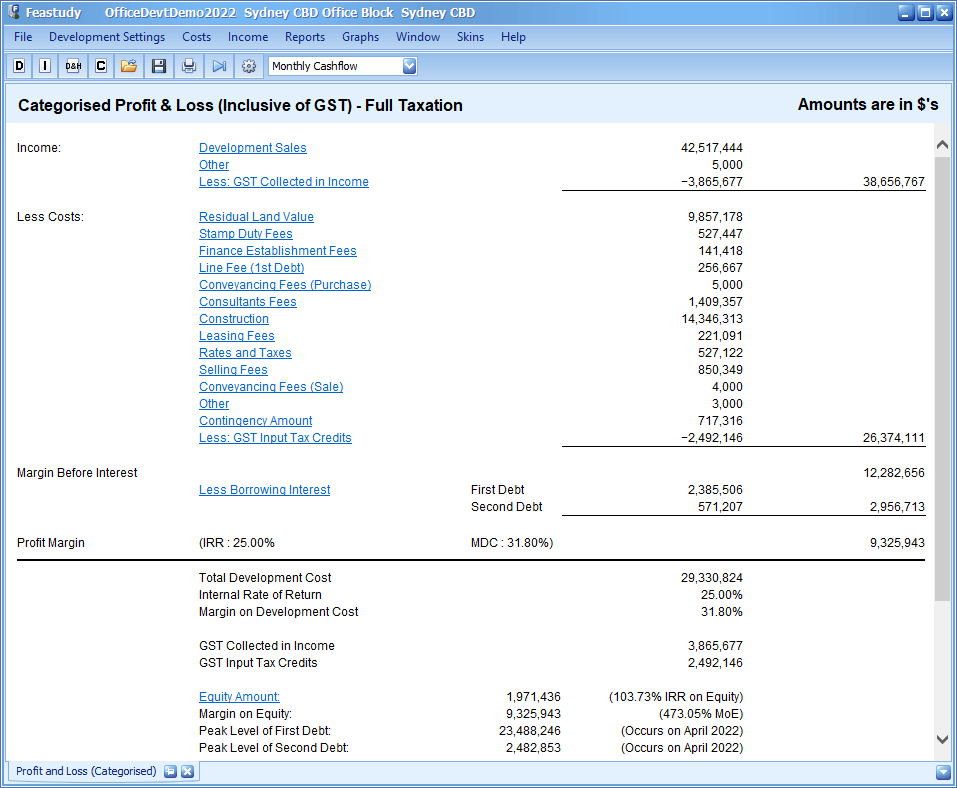

Feastudy 11 is user-friendly in that it enables easy entry of data in a logical and

consistent fashion, gives explanatory text for all data inputs, provides context-sensitive help for all data

entry windows, allows convenient functions for creating, copying and deleting cost or income items in lister

windows and gives on-screen and hardcopy report information in a comprehensive and easily understood format.

Pricing

The price of one licensed copy of Feastudy 11 Professional is AUD$770.00

and one licensed copy of Feastudy 11 Lite is AUD$440.00. Both

prices include: an Activation Key for activating your program copy in licensed mode on up to two PCs at any one time;

and one year’s subscription to our Feastudy Maintenance and Support Services for your program copy which comprise:

(a) any updates of the program which contain minor enhancements and/or modifications to the software;

(b) any upgrades of the program which include major enhancements and/or modifications to the software; and

(c) all reasonable operating and technical support for your use of the software.

One year after your program copy purchase, the annual cost to consecutively resubscribe to our Feastudy Maintenance and Support Services for your program copy will be,

subject to the terms and conditions of our Feastudy 11 (for PC) licence agreement, AUD$220.00.

Enhanced Demo Program

You can trial the interactive Feastudy 11 Professional demonstration program

in Enhanced mode, which allows you to create new feasibility

files, edit them and demo files, save all edited

files, and print all reports and graphs (with a demonstration watermark across them) from those

files for ten (10) days, by downloading the demo program from our

website's Download page and installing it on your PC, however you will require an Activation Key to

do this. Please use our Contact Us form to

get in touch with us and we will email the Activation Key and other relevant details to you.